property tax assistance program montana

You have to meet income and property. Property Tax Assistance Program PTAP the Extended Property Tax Assistance Program EPTAP the Disabled American Veterans DAV Exemption and the Elderly Home.

Tax Breaks For Montana Property Owners Inspect Montana

The property values appraised by the.

. The Property Tax Assistance Program PTAP was created for property owners who need help paying off their taxes which can be quite high considering. General Information Apply by April 15. Montana law includes four programs to offer property tax assistance to residential property taxpayers.

That funding will help Montana. The Land Value Property Tax Assistance Program for Residential Property LVPTAP helps residential property owners if the value of their land is. The American Rescue Plan Act passed by Congress and signed by the president contains 9961 billion nationwide for a Homeowner Assistance Fund HAF.

More about the Montana Form PTAP Other TY 2021. This program applies solely to the first 200000. You May Qualify for an IRS Forgiveness Program.

Montana Disabled Veteran Property Tax Relief Application Form MDV 2022. July 2 2021. 1 There is a property tax assistance program that provides graduated levels of tax assistance for the purpose of assisting citizens.

Adoption Notice PDF 20 KB Proposal Notice PDF 48 KB. Property tax assistance program -- fixed or limited income. Two of the programs are reductions in taxable value one is an.

You may use this form to apply for the Property Tax Assistance Program PTAP. MT QuickFile is for filing a Montana State. Property Tax Assistance Program PTAP will reduce your tax obligation if you meet the following income guidelines.

Ad Reduce property taxes 4 residential retail businesses - profitable side business hustle. Montana has a Property Tax Assistance Program PTAP that helps residents with lower income reduce the property tax rates on their homes. Latest version of the adopted rule presented in Administrative Rules of Montana ARM.

Two of the programs are reductions in taxable value one is an exemption for the. Ad Owe the IRS. Property Tax Assistance Program PTAP Application for Tax Year 2018 15-6-305 MCA Part I.

Property Tax Assistance Program. Reduce Your Back Taxes With Our Experts. Property Tax Assistance Programs.

Ad Apply For Tax Forgiveness and get help through the process. The State Provides Assistance for Low-Income Property Taxpayers The Montana legislature has put in place four distinct programs to reduce property tax liability for some. Montana law includes four programs to offer property tax assistance to residential property taxpayers.

If you are already approved for the Property Tax. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. 21032 or less for a single person or 28043 or less for a married.

Reduce property taxes for yourself or others as a legitimate home business. End Your Tax Nightmare Now. Helena The Montana Department of Revenue wants to let property owners know about a change in state property tax assistance programs to make it easier for taxpayers to.

We would like to show you a description here but the site wont allow us. The Property Assessment Division appraises and values properties and administers certain property taxes in Montana. Property Tax Assistance Programs.

The taxpayer must live in their home for at least seven months out of. The first the Property Tax Assistance Program PTAP reduces residential property taxes for low-income households.

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Mortgage

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

Mhs Mt Gov Shpo Historic Preservation Historical Historical Society

Ci 121 Montana S Big Property Tax Initiative Explained

The Cool Commercial Real Estate Due Diligence Checklist Pertaining To Property Condition Assessm Checklist Template Commercial Real Estate Inspection Checklist

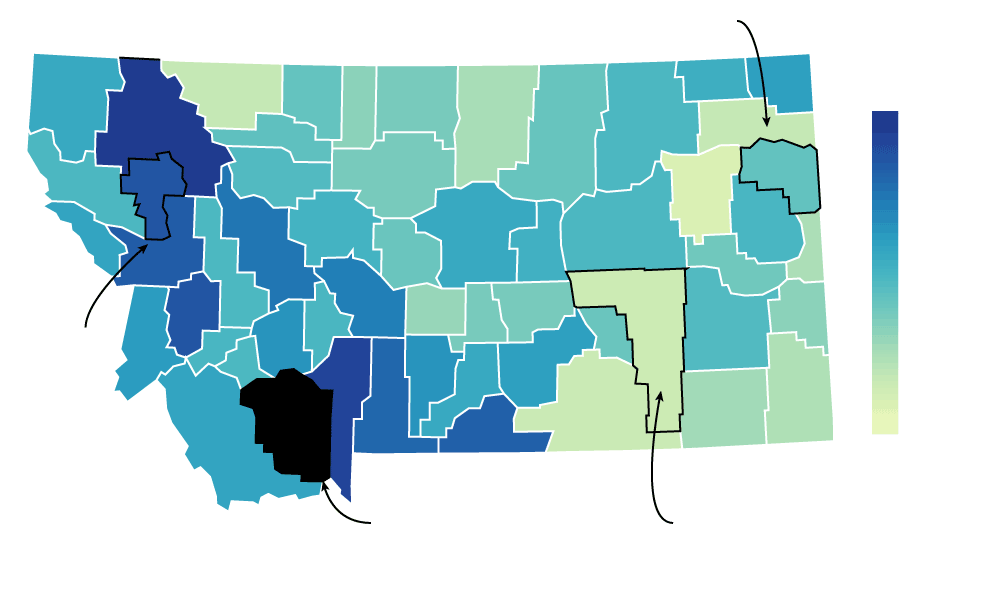

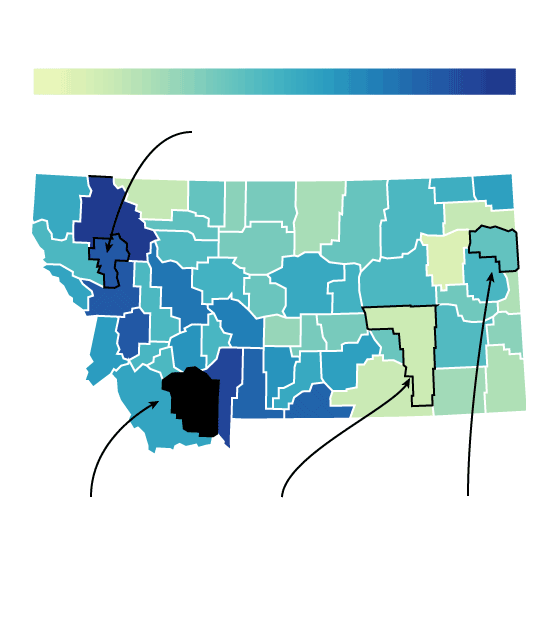

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Taxes Fees Montana Department Of Revenue

Taxes Fees Montana Department Of Revenue

Taxes Fees Montana Department Of Revenue

Property Montana Department Of Revenue

Tax Breaks For Montana Property Owners Inspect Montana

Taxes Fees Montana Department Of Revenue

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Montana Lawmakers Vote Unanimously To Oppose Property Tax Cap Initiative Montana Public Radio

Did You Receive Your Property Appraisal Notice Here S What It Means And What You Can Do About It Missoula County Blog

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press